+39 029363537

• Order intake goes up 9% to € 2,270.6 million (previous year: € 2,088.6 million)

• Sales revenues of € 1,857.7 million are 12% above the previous year (€ 1,656.2 million)

• EBIT rises 20% to € 143.1 million (previous year: € 119.2 million)

• Free cash flow improves by € 79.9 million to € 115.5 million (previous year: € 35.6 million)

Bielefeld // DMG MORI AKTIENGESELLSCHAFT looks back on a successful business performance in the first nine months with high rates of growth in order intake, sales revenues, results and free cash flow. Order intake rose by 9% to € 2,270.6 million. Sales revenues increased by 12% to € 1,857.3 million. EBIT amounted to € 143.1 million – an increase of 20%. Free cash flow improved by € 79.9 to € 115.5 million.

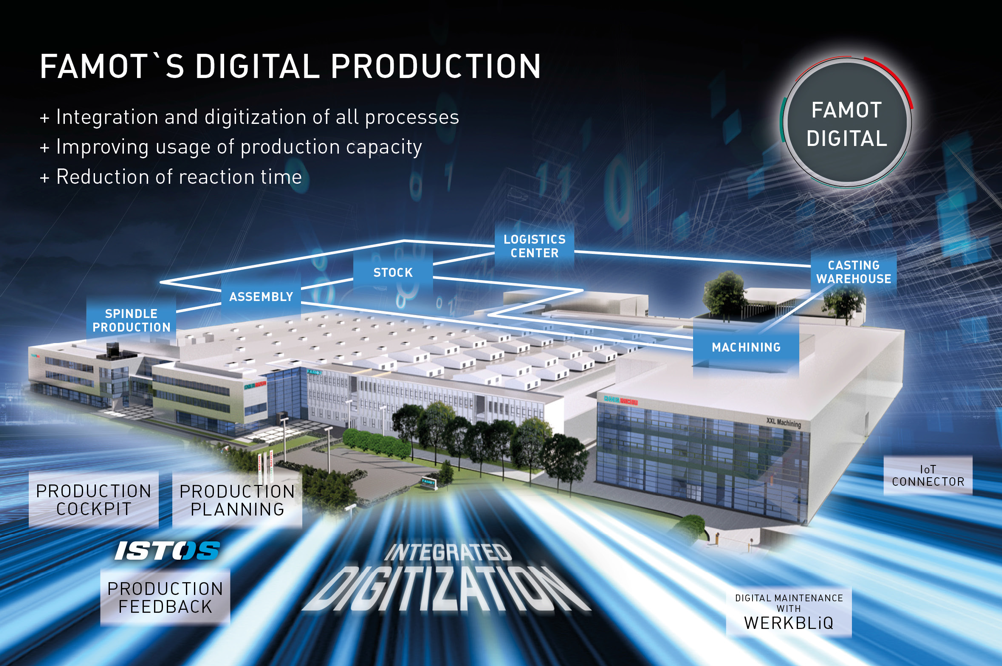

Chairman of the Executive Board Christian Thönes: “DMG MORI is on track. We are dynamically pushing forward our future topics automation, digitization and ADDITIVE MANUFACTURING. We have thus recently extended and continuously digitized our production plant FAMOT in Poland."

Order Intake //

Order intake in the third quarter of 2018 amounted to € 693.5 million (previous year: € 704.4 million). As at 30 September, order intake rose by 9% to € 2,270.6 million (previous year: € 2,088.6 million). Domestic orders were € 681.9 million (+7%; previous year: € 639.3 million). International orders grew by 10% to € 1,588.7 million (previous year: € 1,449.3 million). International orders accounted for 70% of all orders (previous year: 69%).

Sales Revenues //

Sales revenues increased in the third quarter by 17% to € 642.6 million (previous year: € 548.2 million). As at 30 September, sales revenues were up 12% at € 1,857.7 million (previous year: € 1,656.2 million). The export share was 69% as in the previous year.

Order Backlog //

On 30 September 2018 the order backlog amounted to € 1,705.8 million (31 Dec. 2017: € 1,309.1 million). The high order backlog and the very high capacity utilization at the production plants are causing long delivery times at present. We are further counteracting this development with stronger flexibility and sound business relationships with our partners and suppliers. In addition, we are investing further into the expansion of our production capacities in Poland and Pfronten with new assembly and logistics areas as well as with cutting-edge technology and solution centers.

Results of Operations, Financial Position and Net Worth //

Earnings continued to develop positively: In the third quarter EBITDA reached € 63.7 million (previous year: € 55.5 million). EBIT amounted to € 50.1 million (previous year: € 41.6 million) and EBT increased to € 49.4 million (previous year: € 41.2 million). EAT was € 34.6 million (previous year: € 28.5 million). As at 30 September, EBITDA improved to € 184.2 million (+13%; previous year: € 162.8 million). EBIT rose by 20% to € 143.1 million (previous year: € 119.2 million). EBT increased 22% to € 141.7 million (previous year: € 116.4 million). As at 30 September 2018, the group reports EAT of € 99.3 million (previous year: € 80.5 million).

In addition to the good results of operations, the financial position also developed positively: The free cash flow improved by € 79.9 million to € 115.5 million (+224%; previous year: € 35.6 million). In particular the increase in received prepayments to € 369.7 million led to the improvement in cash flow (31 Dec. 2017: € 290.2 million). As at 30 September 2018, the balance sheet total stood at € 2,381.1 million (31 Dec. 2017: € 2,241.3 million). The equity ratio was 52.4% (31 Dec. 2017: 52.0%).

Employees //

On 30 September 2018 the group had 7,479 employees, of whom 412 were trainees (31 Dec. 2017: 7,101). The rise in employee numbers occurred in particular in-service employees both nationally and internationally. In addition, we have increased the staff to strengthen our production capacity at FAMOT as well as in our future strategic topics – above all in the fields of automation, digitization and ADDITIVE MANUFACTURING. At the end of the third quarter, 4,441 employees (59%) worked for our domestic companies and 3,038 employees (41%) for our international companies. The personnel costs amounted to € 434.8 million (previous year: € 402.5 million). The personnel expenses ratio improved to 22.4% (previous year: 23.8%).

Research & Development //

Expenditure on research and development in the first nine months amounted to € 42.4 million (previous year: € 37.5 million). At the AMB in Stuttgart we presented 32 machines, thereof 13 with automation. We demonstrated high-precision additive construction with the LASERTEC 30 SLM 2nd generation. Alongside ADDITIVE MANUFACTURING and automation, a further highlight was the integrated digitization – from the planning and work preparation through to production, monitoring and service.

At the FAMOT production plant we have for the first time digitized our entire value-added chain using our modular products from ISTOS, DMG MORI Software Solutions and WERKBLiQ, which we presented to experts at our grand opening on 8 October. With our digital factory of the future we are setting standards worldwide.

Forecast //

The worldwide market for machine tools is expected to grow by +8.5% to € 77.2 billion in 2018 according to the latest forecasts of the German Machine Tool Builders´ Association (VDW) and the British economic research institute, Oxford Economics (April forecast: +5.9%). However, currency effects and the possible effects of geo-political uncertainties, such as the trade conflict between the USA and China as well as the current debt situation in Italy, have not been taken into account. When adjusted for currency effects, the euro-based forecast shows growth of +5.2% (€ 74.8 billion) and thus first tendencies of a decreasing dynamic (April forecast: +6.1%).

DMG MORI is raising its target for order intake for the whole year based on the good development of order intake in the first nine months: order intake is now expected to reach around € 2.9 billion (previously: around € 2.7 billion). Sales revenues remain unchanged at about € 2.55 billion. EBT is expected to be about € 200 million. For free cash flow we are expecting about € 125 million for the entire year.

DMG MORI is well-positioned technologically, structurally and culturally. Our unique combination of dynamics and excellence forms a solid basis for the future and changing market conditions.

DMG MORI AKTIENGESELLSCHAFT

The Executive Board